Thursday, August 5, 2010

Dan Loeb's hedge fund firm Third Point LLC is out with its July Offshore fund portfolio (Marketfolly)

"Dan Loeb's hedge fund firm Third Point LLC is out with its July Offshore fund portfolio disclosure. For the month of July, the fund was up 3.2%. Year to date for 2010, the fund is up 13.7%. Third Point currently has an impressive 17.9% annualized return with a Sharpe Ratio of 1.25 and a correlation to the S&P 500 of 0.40. To learn to become a successful investor like this hedge fund manager, we'd obviously point you to Dan Loeb's recommended reading list.In their latest portfolio breakdown, we see some changes worth highlighting. Here's a look at Third Point's top five positions:1. Chrysler (multiple securities)2. Delphi Corp (multiple securities)3. CIT Group (multiple securities) 4. Dana Holding Corp (multiple securities) 5. Anadarko Petroleum (APC)Keep in mind that 'multiple securities' simply means that they own numerous positions across the capital structure in that specific company and this list takes into account their collective position. Right away there are two major portfolio changes to notify you about. Firstly, Dan Loeb has started a brand new position in Anadarko Petroleum (APC) because it did not appear when we examined Third Point's Q1 portfolio. They've started this position presumably as shares have tumbled due to APC's partial operating stake in the deepwater rig responsible for the oil spill in the Gulf of Mexico. While BP (BP) has taken the majority of the blame for the spill, Anadarko owned a 25% interest and thus bears some liability.This means that Loeb has joined the ranks of other prominent investors who have identified opportunity as a result of the Gulf oil spill. Just yesterday we highlighted Grey Owl Capital's purchase of Transocean (RIG). Prior to that, Whitney Tilson's T2 Partners bought BP (BP) as they feel the company will have no problem surviving. And although this next company was not directly involved in the spill, David Einhorn's Greenlight Capital purchased Ensco (ESV) as a result of the sector trading down.The second portfolio change to highlight is in Third Point's PHH Corp (PHH) position. In previous portfolio disclosures, Loeb's hedge fund has listed PHH as one of their top 5 holdings (they owned multiple PHH securities). This time around, however, PHH is not listed in their top 5 positions. This leaves a few scenarios in play: Third Point could have sold part or all of their stake in PHH, or they could have raised their stake in other positions ahead of PHH (for instance their new stake in Anadarko). There's no way to know which scenario is the case and this could only be a minor change, but we'll have to wait to verify. PHH shares traded up 11% yesterday as the company reiterated its full year earnings outlook. In terms of other recent portfolio activity, we've highlighted Third Point's stake in Emmis Communications (EMMSP).Let's next move to the top winners in their portfolio for July. These included their longs of Delphi (multiple securities), Atlas Pipeline (APL), Chrysler (multiple securities), Lyondell (LALLF), and an undisclosed short position. Of these stakes, you'll recall that Jamie Dinan of York Capital is bullish on Lyondell as well. Third Point's top losing positions for the month consisted of Gala Casino (multiple securities), SemCrude LP (multiple securities), Peregrine Metals (multiple securities) and two undisclosed short positions.Next, let's focus on their latest exposure levels. In equities, Third Point is long 43.8%, short -12.1%, leaving them net long to the tune of 31.7%. Their largest sector net longs are in Consumer at 8%, Financials at 8%, and Basic Materials at 6%. In credit, Third Point is 50.6% net long with their largest exposure coming from MBS at 19.1%. Their distressed exposure comes in at 16.4% and their Performing exposure at 15.1%. Third Point has significantly reduced their distressed exposure as they were previously 25.1% net long and now are only 16.4% net long. Lastly, in terms of geographic exposure, Dan Loeb's hedge fund is net long the Americas at 84%, net long Europe at 13% and net short Asia at -1%.

Monday, July 26, 2010

What I have read this week (July 26)

2 How Apple maintains explosive earnings growth (Fortune)

3 Paulson To Launch Retail Version Of Flagship In Europe (FINalternatives)

4 A Short History of Financial Euphoria by John Kenneth Galbraith

5 What Hedge Funds Are Seeing in the Current Market (at Seeking Alpha)

Saturday, July 17, 2010

Friday confirmed my prediction, bear market ahead

I have already reduced my long exposure and begin to bet against the market. This is going to be a tough summer for investors. Be patient and I am sure the market avalanche will turn out to be a good buying opportunity by the end of the year when the bulls coming back.

Thursday, July 15, 2010

What I have read this week (July 12)

2 Investing: When Cash Takes a Vacation (at BusinessWeek)

3 Hedge Fund Third Point Files 13D on Emmis Communications (EMMSP) (Marketfolly)

4 David Einhorn's Hedge Fund Greenlight Capital Buys Ensco (ESV) (Marketfolly)

5 One Up On Wall Street by Peter Lynch

Wednesday, July 7, 2010

What are we expecting in July?

If we take a look at the historic data, we will find that there has never been a bearish market that lasted more than three years, not even the 1929 market catastrophe. The longest market contraction happened during the 2000 technology stock bubble, which lasted about three years and followed by a big bull market (Shown in the graph below). If this is true, then we can expect to see a bull market soon because it is almost been three year since the market started to tumble during the end of 2007. Therefore, for the worst,we have yet 4 or 5 months left to see the bull coming back. However, we do not need to be that pessimistic. The martket is very likely to rally before the end of this year, if certain conditions can be met.

As for now, I am sticking with my bearish view about the market. I have always held the view that the market will have another big tumble in 2010 after a bullish year in 2009. I was proven to be right as the market went down in May and June. Despite today's big surge, I am still very bearish. Today's big increase is very likely to be a retaliatory surge after the market touched resistance at about 9700. However, it is going to face another price celling at about 10,450. If the market fails to achieve this level in the next couple of days, I will say there will be a big market decline. The Dow could be as low as somewhere around 8500 before the expected bullish market coming in the end of the year. However, if the Dow rises above the celling price in the coming weeks, it is very likely for us to jump right into the bull market I just talked about.

Until then, my suggestion is to be consevative and be prepared for another market dip.

Monday, June 28, 2010

What I have read this week (June 28)

2 SandRidge hedge fund hit in June by natgas trades (Reuters)

3 AOL Waves Bye-Bye To Bebo (Forbes)

4 BP shares hit 14-year-low; shares down over $104B (Yahoo Finance)

5 FACTBOX-New regulations limit banks' investments in hedge funds (Reuters)

6 Asian hedge fund hopes take a dive in 2010

Cliff Asness discusses trading strategies in AQR Captical Management

Sunday, June 20, 2010

What I have read this week (June 21)

2 SandRidge hedge fund hit in June by natgas trades (Reuters)

3 AOL Waves Bye-Bye To Bebo (Forbes)

4 Hedge Hunters: Hedge Fund Masters on the Rewards, the Risk, and the Reckoning by Katherine Burton

5 Gold Is Good, But Gold Mining Is Better (Marketfolly)

6 BNP Vet McGrath Garners $500M For Hedge Fund (FINalternatives)

Thursday, June 17, 2010

Jim Chanos is Short-Selling Ford

Tuesday, June 15, 2010

Hedge Fund Analysis on Dan Loeb's Third Point (2010 Q1)

5/21/10

buy

Airgas Inc [ARG]

$61.48

5/21/10

buy

Liberty Interactive [LINTA]

$12.67

5/21/10

buy

OSI Pharm Inc [OSIP]

$57.38

5/21/10

buy

Walgreen Co [WAG]

$33.10

5/21/10

sell

Cablevision Systems Cp Class A [CVC]

$23.20

5/21/10

sell

Citigroup Inc [C]

$ 3.75

5/21/10

sell

Mead Johnson Nutrition [MJN]

$49.09

2/19/10

buy

CIT Group Inc [CIT]

$32.62

2/19/10

buy

Cablevision Systems Cp Class A [CVC]

$22.91

2/19/10

buy

Citigroup Inc [C]

$ 3.42

2/19/10

buy

Mead Johnson Nutrition [MJN]

$46.58

2/19/10

buy

Wellpoint Inc. [WLP]

$58.47

2/19/10

buy

Xerox Corp [XRX]

$ 9.16

2/19/10

sell

Bank of America Corp [BAC]

$15.86

2/19/10

sell

CF Industries Holdings Inc [CF]

$104.00

2/19/10

sell

Liberty Acquisition Holdings Corp [LIA]

$ 9.75

2/19/10

sell

Molson Coors Brewing Co [TAP]

$40.59

2/19/10

sell

Pfizer Inc [PFE]

$17.80

2/19/10

sell

Popular Inc [BPOP]

$ 2.00

Monday, June 14, 2010

This week's highlights on hedge funds (June 07-14, 2010)

2 Ex-SAC President Cohn To Launch Hedge Fund (FINalternatives)

3 Possible EU Compromise On Foreign Hedge Funds (FINalternatives)

4 Stock-Market Brainiac Starts Hedge Fund (The Street)

5 Hedge Fund Industry Platform Should Boost Transparency and Efficiency (Seeking Alpha)

Sunday, June 13, 2010

What I have read this week (June 14)

2 The Quants by Scott Patterson

3 Wall Street to cities: wanna sell that bridge? (Fortune)

4 Why the worst isn't over yet (Fortune)

5 Europe's Banks May Face Second Funding Squeeze Amid Sovereign-Debt Crisis ( Bloomberg)

Hedge Fund Analysis on William Ackman's Pershing Square Capital Management (2010 Q1)

Total Market Value: $ 3.32 Billion

Top Sectors: 70% Services

30% Consumer-non cyclical

Top 8 positions

1 Target (TGT): 32.79%

2 Kraft Foods (KFT): 29.89%

3 Yum Brands (YUM): 17.56%

4 General Growth Properties (GGP): 11.62%

5 Corrections Corp of America (CXW): 6.55%

6 Landry's Restaurants (LNY): 0.84%

7 Borders Group (BGP): 0.55%

8 Greenlight Capital Re (GLRE): 0.20%

Recent Trades:

5/21/10

buy

General Growth Properties [GGP]

$13.12

5/21/10

buy

Kraft Foods Inc [KFT]

$29.69

5/21/10

buy

Yum! Brands [YUM]

$40.15

5/21/10

sell

Automatic Data Process [ADP]

$40.28

5/21/10

sell

Hyatt Hotels Corp [H]

$37.85

2/19/10

buy

Hyatt Hotels Corp [H]

$29.97

2/19/10

buy

Landry Restaurant [LNY]

$20.50

2/19/10

sell

EMC Corp [EMC]

$17.81

2/19/10

sell

Mcdonalds Corp [MCD]

From the Portfolio, we can see that Ackman was very long on consumers goods and retailers. It increased its stake in Kraft and Yum Brands during the filling in May. He was very confident that the economy is in recovery and hence consumers will soon increase their spending.

Recently, we learned that Target's sales outperformed the industry average in May (see report here) and Bill also started a position in Citi group.

Here is an interview with Bill Ackman on why he is interested in the Citi.

Taken from Alphaclone, "Pershing Square is a New York based activist, fundamental value hedge fund founded by William Ackman in 2003. In addition to being a Founder and Trustee at Pershing Square Capital Management, L.P, Mr. Ackman is also a Co-Founder and Chief Executive Officer at Gotham Partners Management Co., LLC and has co-managed the partnership since its inception. Mr. Ackman has been the Co-Investment Manager at Gotham LP, Gotham III LP, and Gotham Partners International Limited since January 1993."

Hedge Fund Analysis on John Paulson's Paulson & Co (2010 Q1)

I have posted John Paulson's Q1 performance before (click here to see), however, this analysis is dedicated to give a more detailed analysis of the performance of this New York based hedge fund. Please note that most of the Data comes from Alphaclone, unless otherwise indicated.

Total Market Value (as of the end of March): $21.16 Billion

Top Sectors: 59% Financials

13% Basic Materials

11% Services

6% Energy

5% Healthcare

Top 10 Holdings

1. SPDR Gold Trust (GLD): 16.2%

2. Bank of America (BAC): 14.2%

3. Citigroup (C): 9.7%

4. Anglogold Ashanti (AU): 7.8%

5. Comcast (CMCSA) 3.9%

6. Suntrust Banks (STI): 3.8%

7. Boston Scientific (BSX): 3.4%

8. Capital One (COF): 3.3%

9. XTO Energy (XTO): 2.9%

10. Kinross Gold (KGC): 2.7%

Recent Trades

5/21/10

buy

XTO Energy Inc [XTO]

$42.95

2/19/10

buy

Capital One Financial [COF]

$37.75

2/19/10

buy

Comcast Corp Class A [CMCSA]

$15.92

2/19/10

buy

Suntrust Bank Inc [STI]

$23.01

2/19/10

sell

Liberty Med A [LSTZA]

$46.98

2/19/10

sell

Sun Microsystems [JAVA]

$ 9.49

We can see from Paulson's portfolio that he held a large position in Gold in the first quarter, which indicates he was still very bearish about the market. As seen from the performance of the DJIA in May, Paulson was absolutely right. Paulson also showed interest in financial groups such as Citi Group, Bank of America, and JP Morgan chase. Unfortunately, these stocks weren't performing very well in May. My guess is that Paulson still holds them in the second quarter and therefore suffered some loss in May.

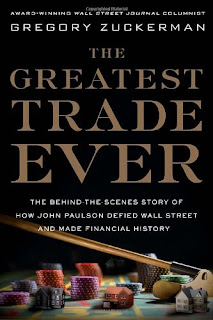

Paulson is famous for his bet against the CDO market in 2007, to read more about his story, you can refer to The Greatest Trade Ever, written by Wall Street Journal columnist Greg Zuckerman.

Taken from the Alphaclone

"Paulson & Co. (PCI) is an employee owned hedge fund sponsor. Founded by John Alfred Paulson, the firm primarily provides its services to pooled investment vehicles. The firm invests in the public equity markets across the globe and employs strategies such as merger arbitrage, long/short, and event-driven strategy to make its investments. It employs fundamental analysis to make its investments. Paulson & Co. was founded in July 1994 and is based in New York, New York."

Thursday, June 10, 2010

Dan Loeb's Third Point Discloses Roomstore Position (Market Folly)

This is the first time Third Point has disclosed this position because in their last 13F filing that detailed positions as of March 31st, 2010 they did not show a stake. For the rest of Loeb's investments, we covered Third Point's equity portfolio. To get a better idea as to Loeb's overall portfolio allocations, check out Third Point's latest exposure levels.

Taken from Yahoo Finance, Roomstore is "engages in the retail sale of furniture, bedding, and home decorating accessories through its retail stores and Internet operations."

Read more on market folly: http://www.marketfolly.com/

Wednesday, June 9, 2010

Whitney Tilson of T2 Partners on BP: BP is just too cheap

Sunday, June 6, 2010

What I have read this week (June 7)

2 Small cap picks by hedge funds (the street)

3 Ratings Agencies a 'Public Bad,' Should Be Tossed: Einhorn (CNBC)

4 Debtors’ Prism: Who Has Europe’s Loans? (New York Times)

Saturday, June 5, 2010

This week's highlights on hedge funds (May 31- June 06, 2010)

2 Greenlight Capital's David Einhorn shorting ratings agencies (Hedgetracker)

3 Credit Suisse: May Dismal for Most Hedge Fund Strategies (Seeking Alpha)

4 China Vets Team Up To Launch Long/Short Hedge Fund (FINalternatives)

5 Steve Cohen wants to sell stake in SAC Capital (Hedgetracker)

6 Why Bill Ackman Bought Citigroup Stake (Seeking Alpha)

7 Einhorn's Greenlight Capital Offshore Bucks Trend In May, Gains 0.3% (FINalternatives)

8 Third Point Takes A Hit In May, But Still Up Double Digits YTD (FINalternatives)

9 Lippmann Finally Leaves Deutsche Bank To Launch Hedge Fund (FINalternatives)

Friday, June 4, 2010

Barron's interview with Ray Dalio (transcript)

Dalio: Let's call it a "D-process," which is different than a recession, and the only reason that people really don't understand this process is because it happens rarely. Everybody should, at this point, try to understand the depression process by reading about the Great Depression or the Latin American debt crisis or the Japanese experience so that it becomes part of their frame of reference. Most people didn't live through any of those experiences, and what they have gotten used to is the recession dynamic, and so they are quick to presume the recession dynamic. It is very clear to me that we are in a D-process.

Why are you hesitant to emphasize either the words depression or deflation? Why call it a D-process?

Both of those words have connotations associated with them that can confuse the fact that it is a process that people should try to understand.

You can describe a recession as an economic retraction which occurs when the Federal Reserve tightens monetary policy normally to fight inflation. The cycle continues until the economy weakens enough to bring down the inflation rate, at which time the Federal Reserve eases monetary policy and produces an expansion. We can make it more complicated, but that is a basic simple description of what recessions are and what we have experienced through the post-World War II period. What you also need is a comparable understanding of what a D-process is and why it is different.

You have made the point that only by understanding the process can you combat the problem. Are you confident that we are doing what's essential to combat deflation and a depression?

The D-process is a disease of sorts that is going to run its course.

When I first started seeing the D-process and describing it, it was before it actually started to play out this way. But now you can ask yourself, OK, when was the last time bank stocks went down so much? When was the last time the balance sheet of the Federal Reserve, or any central bank, exploded like it has? When was the last time interest rates went to zero, essentially, making monetary policy as we know it ineffective? When was the last time we had deflation?

The answers to those questions all point to times other than the U.S. post-World War II experience. This was the dynamic that occurred in Japan in the '90s, that occurred in Latin America in the '80s, and that occurred in the Great Depression in the '30s.

Basically what happens is that after a period of time, economies go through a long-term debt cycle -- a dynamic that is self-reinforcing, in which people finance their spending by borrowing and debts rise relative to incomes and, more accurately, debt-service payments rise relative to incomes. At cycle peaks, assets are bought on leverage at high-enough prices that the cash flows they produce aren't adequate to service the debt. The incomes aren't adequate to service the debt. Then begins the reversal process, and that becomes self-reinforcing, too. In the simplest sense, the country reaches the point when it needs a debt restructuring. General Motors is a metaphor for the United States.

As goes GM, so goes the nation?

The process of bankruptcy or restructuring is necessary to its viability. One way or another, General Motors has to be restructured so that it is a self-sustaining, economically viable entity that people want to lend to again.

This has happened in Latin America regularly. Emerging countries default, and then restructure. It is an essential process to get them economically healthy.

We will go through a giant debt-restructuring, because we either have to bring debt-service payments down so they are low relative to incomes -- the cash flows that are being produced to service them -- or we are going to have to raise incomes by printing a lot of money.

It isn't complicated. It is the same as all bankruptcies, but when it happens pervasively to a country, and the country has a lot of foreign debt denominated in its own currency, it is preferable to print money and devalue.

Isn't the process of restructuring under way in households and at corporations?

They are cutting costs to service the debt. But they haven't yet done much restructuring. Last year, 2008, was the year of price declines; 2009 and 2010 will be the years of bankruptcies and restructurings. Loans will be written down and assets will be sold. It will be a very difficult time. It is going to surprise a lot of people because many people figure it is bad but still expect, as in all past post-World War II periods, we will come out of it OK. A lot of difficult questions will be asked of policy makers. The government decision-making mechanism is going to be tested, because different people will have different points of view about what should be done.

What are you suggesting?

An example is the Federal Reserve, which has always been an autonomous institution with the freedom to act as it sees fit. Rep. Barney Frank [a Massachusetts Democrat and chairman of the House Financial Services Committee] is talking about examining the authority of the Federal Reserve, and that raises the specter of the government and Congress trying to run the Federal Reserve. Everybody will be second-guessing everybody else.

So where do things stand in the process of restructuring?

What the Federal Reserve has done and what the Treasury has done, by and large, is to take an existing debt and say they will own it or lend against it. But they haven't said they are going to write down the debt and cut debt payments each month. There has been little in the way of debt relief yet. Very, very few actual mortgages have been restructured. Very little corporate debt has been restructured.

The Federal Reserve, in particular, has done a number of successful things. The Federal Reserve went out and bought or lent against a lot of the debt. That has had the effect of reducing the risk of that debt defaulting, so that is good in a sense. And because the risk of default has gone down, it has forced the interest rate on the debt to go down, and that is good, too.

However, the reason it hasn't actually produced increased credit activity is because the debtors are still too indebted and not able to properly service the debt. Only when those debts are actually written down will we get to the point where we will have credit growth. There is a mortgage debt piece that will need to be restructured. There is a giant financial-sector piece -- banks and investment banks and whatever is left of the financial sector -- that will need to be restructured. There is a corporate piece that will need to be restructured, and then there is a commercial-real-estate piece that will need to be restructured.

Is a restructuring of the banks a starting point?

If you think that restructuring the banks is going to get lending going again and you don't restructure the other pieces -- the mortgage piece, the corporate piece, the real-estate piece -- you are wrong, because they need financially sound entities to lend to, and that won't happen until there are restructurings.

On the issue of the banks, ultimately we need banks because to produce credit we have to have banks. A lot of the banks aren't going to have money, and yet we can't just let them go to nothing; we have got to do something.

But the future of banking is going to be very, very different. The regulators have to decide how banks will operate. That means they will have to nationalize some in some form, but they are going to also have to decide who they protect: the bondholders or the depositors?

Nationalization is the most likely outcome?

There will be substantial nationalization of banks. It is going on now and it will continue. But the same question will be asked even after nationalization: What will happen to the pile of bad stuff?

Let's say we are going to end up with the good-bank/bad-bank concept. The government is going to put a lot of money in -- say $100 billion -- and going to get all the garbage at a leverage of, let's say, 10 to 1. They will have a trillion dollars, but a trillion dollars' worth of garbage. They still aren't marking it down. Does this give you comfort?

Then we have the remaining banks, many of which will be broke. The government will have to recapitalize them. The government will try to seek private money to go in with them, but I don't think they are going to come up with a lot of private money, not nearly the amount needed.

To the extent we are going to have nationalized banks, we will still have the question of how those banks behave. Does Congress say what they should do? Does Congress demand they lend to bad borrowers? There is a reason they aren't lending. So whose money is it, and who is protecting that money?

The biggest issue is that if you look at the borrowers, you don't want to lend to them. The basic problem is that the borrowers had too much debt when their incomes were higher and their asset values were higher. Now net worths have gone down.

Let me give you an example. Roughly speaking, most of commercial real estate and a good deal of private equity was bought on leverage of 3-to-1. Most of it is down by more than one-third, so therefore they have negative net worth. Most of them couldn't service their debt when the cash flows were up, and now the cash flows are a lot lower. If you shouldn't have lent to them before, how can you possibly lend to them now?

I guess I'm thinking of the examples of people and businesses with solid credit records who can't get banks to lend to them.

Those examples exist, but they aren't, by and large, the big picture. There are too many nonviable entities. Big pieces of the economy have to become somehow more viable. This isn't primarily about a lack of liquidity. There are certainly elements of that, but this is basically a structural issue. The '30s were very similar to this.

By the way, in the bear market from 1929 to the bottom, stocks declined 89%, with six rallies of returns of more than 20% -- and most of them produced renewed optimism. But what happened was that the economy continued to weaken with the debt problem. The Hoover administration had the equivalent of today's TARP [Troubled Asset Relief Program] in the Reconstruction Finance Corp. The stimulus program and tax cuts created more spending, and the budget deficit increased.

At the same time, countries around the world encountered a similar kind of thing. England went through then exactly what it is going through now. Just as now, countries couldn't get dollars because of the slowdown in exports, and there was a dollar shortage, as there is now. Efforts were directed at rekindling lending. But they did not rekindle lending. Eventually there were a lot of bankruptcies, which extinguished debt.

In the U.S., a Democratic administration replaced a Republican one and there was a major devaluation and reflation that marked the bottom of the Depression in March 1933.

Where is the U.S. and the rest of the world going to keep getting money to pay for these stimulus packages?

The Federal Reserve is going to have to print money. The deficits will be greater than the savings. So you will see the Federal Reserve buy long-term Treasury bonds, as it did in the Great Depression. We are in a position where that will eventually create a problem for currencies and drive assets to gold.

Are you a fan of gold?

Yes.

Have you always been?

No. Gold is horrible sometimes and great other times. But like any other asset class, everybody always should have a piece of it in their portfolio.

What about bonds? The conventional wisdom has it that bonds are the most overbought and most dangerous asset class right now.

Everything is timing. You print a lot of money, and then you have currency devaluation. The currency devaluation happens before bonds fall. Not much in the way of inflation is produced, because what you are doing actually is negating deflation. So, the first wave of currency depreciation will be very much like England in 1992, with its currency realignment, or the United States during the Great Depression, when they printed money and devalued the dollar a lot. Gold went up a whole lot and the bond market had a hiccup, and then long-term rates continued to decline because people still needed safety and liquidity. While the dollar is bad, it doesn't mean necessarily that the bond market is bad.

I can easily imagine at some point I'm going to hate bonds and want to be short bonds, but, for now, a portfolio that is a mixture of Treasury bonds and gold is going to be a very good portfolio, because I imagine gold could go up a whole lot and Treasury bonds won't go down a whole lot, at first.

Ideally, creditor countries that don't have dollar-debt problems are the place you want to be, like Japan. The Japanese economy will do horribly, too, but they don't have the problems that we have -- and they have surpluses. They can pull in their assets from abroad, which will support their currency, because they will want to become defensive. Other currencies will decline in relationship to the yen and in relationship to gold.

And China?

Now we have the delicate China question. That is a complicated, touchy question.

The reasons for China to hold dollar-denominated assets no longer exist, for the most part. However, the desire to have a weaker currency is everybody's desire in terms of stimulus. China recognizes that the exchange-rate peg is not as important as it was before, because the idea was to make its goods competitive in the world. Ultimately, they are going to have to go to a domestic-based economy. But they own too much in the way of dollar-denominated assets to get out, and it isn't clear exactly where they would go if they did get out. But they don't have to buy more. They are not going to continue to want to double down.

From the U.S. point of view, we want a devaluation. A devaluation gets your pricing in line. When there is a deflationary environment, you want your currency to go down. When you have a lot of foreign debt denominated in your currency, you want to create relief by having your currency go down. All major currency devaluations have triggered stock-market rallies throughout the world; one of the best ways to trigger a stock-market rally is to devalue your currency.

But there is a basic structural problem with China. Its per capita income is less than 10% of ours. We have to get our prices in line, and we are not going to do it by cutting our incomes to a level of Chinese incomes.

And they are not going to do it by having their per capita incomes coming in line with our per capita incomes. But they have to come closer together. The Chinese currency and assets are too cheap in dollar terms, so a devaluation of the dollar in relation to China's currency is likely, and will be an important step to our reflation and will make investments in China attractive.

You mentioned, too, that inflation is not as big a worry for you as it is for some. Could you elaborate?

A wave of currency devaluations and strong gold will serve to negate deflationary pressures, bringing inflation to a low, positive number rather than producing unacceptably high inflation -- and that will last for as far as I can see out, roughly about two years.

Given this outlook, what is your view on stocks?

Buying equities and taking on those risks in late 2009, or more likely 2010, will be a great move because equities will be much cheaper than now. It is going to be a buying opportunity of the century.

Thanks, Ray.

Thursday, June 3, 2010

May retail sales shows consumer concerns over the world economy

(Data from Thomson Reuters)

US retails sales rose at a slower pace than April by increasing 2.5 percent. This indicates that consumers still have concerns about the economic recovery. May is the worst month for consumers, companies and hedge funds for this year. We covered the perfomance of hedge funds in May just a few days ago. (Take a look at the hedge funds performance in May).

Wednesday, June 2, 2010

Warren Buffett defends for Moody's at the FCIC

Mr. Buffett refused to attend the testimony first until he received a subpoena saying that his attendance is necessary. It is easy to guess why he did not want to appear in the testimony. The fact is that the FCIC asked the wrong person. Neither Mr McDaniel nor Mr. Buffett know what went wrong with the rating system. The ways which rating agencies rate financial assets are not transparent, which makes people unable to evaluate the credibility of the rating agencies. Only certain people in the Moody's and Fitch know the details of the rating process. Mr McDanile surely is not in this group.

From a perspective as a foreigner, all US hearings are useless. They either ask the wrong questions or they ask the wrong people. Just like in the Toyota's case, Akio Toyoda were being asked several technical problems. How could he know the details of the mechanic problem as a executive? Obviously, the hearing would be fruitless if you ask an non-expertise.

Anyway, here are the videos from CNBC on today's hearing. Enjoy!

Part 1

Part 2

Part 3

Tuesday, June 1, 2010

May turned out to be a tough month for hedge funds

As the DJIA dropped about 1000 points in May, investors suffered serious losses and poured money into bond market seeking for protection. The 10 year government bond raises in value in May and yielding as low as 3.28 on June 1, 2010 .

The individuals were not the only losers in the previous month, so did the hedge funds.

Here is a glimps of thier performance through May 20, which is rather disappointing .

Paulson & Co

Advantage fund -6.9%

Viking Global fund - 3.4%

Citadel Investment -2.0%

Moore Global fund -7.7%

SAC Capital Advisors -2.9%

Och-Ziff Capital Management Group

OZ Master Fund -1.69%

Hedge funds lost an average of 2.7 percent last month according to Bloomberg News.

Monday, May 31, 2010

What I have read this week (May 31)

Cramer's 'Mad Money' Recap: RIP Buy-and-Hold (Final) (The Street)

Seven worries for Wall Street, and what's next (Market Watch)

SEC Approves Rule Changes to Enhance Municipal Securities Disclosure (SEC Website)

Easy Money, Hard, from David Einhorn, the head of Greenlight Capital (Dealbook)

Saturday, May 29, 2010

This week's highlights on hedge funds (May 24-30, 2010)

Here are some of the hottest headlines about the hedge fund industry of the week. Funds that I am focusing on are in Italics.

1 David Einhorn's Greenlight Capital raises $130 million for Gold Hedge Funds as Jon Paulson did at the start of 2010. (hedgetracker.com) It looks like they are not confident about the economy recovery and European Commission's effort in saving its members.

2 Pequot and Its Chief Settle Insider Complaint (Dealbook)

3 Hedge funds, such as Soros Fund Management and SAC Capital, are betting against the Euro. The financial pros believe the situation in Europe is going to deteriorate under the gloom of the PIGS's debt problem. Recently, rating agency Filtch downgraded the ratings of Spain's credit rating.

4 Greenlight Capital Fund Manager Einhorn Now Top Holder At NCR (WSJ)

5 Carried-Interest Tax Hike Delayed Until 2011 (FINalternatives)

Hedge Fund Tracking

For one of my school's projects, I will focus on 5 of them, posting anything new about them. They are: David Einhorn's Greenlight Capital, Dan Loeb's Third Point LLC, John Paulson's Paulson & Co, James Simons's Renaissance Technologies and Bill Ackman's Pershing Square Capital Management.

Take a look at how are these funds doing for the first quarter of 2010 (Data from the Marketfolly).

Greenlight Capital -1.33%

Third Point LLC

Offshore fund +15.58%

Ultra fund + 16.5%

Partners fund +16.9%

Paulson & Co

Advantage Plus fund -1.18%

Advantage fund -0.93%

International fund +o.47%

Credit fund +3.35%

Enhanced fund +0.99

Renaissance Technologies

RIEF +4.82%

Pershing Square Capital Management +5.62%

(To see performances of some of the most well known hedge funds for the first quarter of 2010, visit the Markt Folly http://www.marketfolly.com/2010/04/hedge-fund-performance-numbers-first.html).

Third Point LLC is a registered investment adviser based in New York, which manages about $3.4 billion of assets. The firm was founded in 1995 by Daniel S. Loeb, who is CEO and oversees all investment activity. Third Point employs an event driven, value oriented investment style.

Tuesday, May 25, 2010

Book Review: The Greatest Trade Ever by Gregory Zuckerman

I believe the transaction itself is, undoubtedly, the “greatest”. However, this does not mean that Paulson was the greatest or the smartest guy at that time. In fact, many people, though not the majority, had perceived the bubbles in the mortgage securities in the late 2006, including those who were lending money to the unqualified borrower. I know you are not convinced since nobody will dump their money if they know they are going to lose them all. An ordinary explanation would be that “people are greedy”. That is true, but not complete. The fact that people were conservative is the explanation for all these things happened! These financial pros, even successfully foresaw the crisis, would unlikely to bet against the market. The reason is that they had a job which would stop them from making the rational decisions. There were many traders and investors in the market, who were constantly competing for customers. Suppose you were trader who was selling mortgage securities to your clients in 2005, you would unlikely to do something that is going to lose your clients by stop selling the securities that were going up every day. Again, suppose you were a fund manager in 2005, you would unlikely to choose to risk your client’s money by betting against the real estate when it was going up. So no matter on the buy side or the sell side, you were doomed to fail. Even you were among the few who chose to take the risk, any gain in the housing prices would put you in a difficult situation. Frequent calls from your clients asking you to clean you positions, blame from your boss and laughter from your competitors. As someone who has used up all the savings to finish your business school and works like a dog for years, you do not want to lose your job on Wall Street. Besides, the tools used in the Paulson’s trade were brand new and only a few people had heard of them at that time. No one would like to try tools that they are not familiar with. This is why hardly any person could successfully make a fortune in the crisis. It was not just because people wanted to make money, but also because people wanted to survive by protecting themselves from any bad outcomes possible. Conservativeness is the ultimate human nature.

Monday, May 24, 2010

what I have read this week (May 24)

2 HSBC Suffers Euro Collapse as Greek Debts Roil Banks (Bloomberg)

3 List of Most-Loved Hedge Fund Stocks, Via Goldman (WSJ)

4 Fed boss: Fed must be free from political meddling (Yahoo Finance)

5 2010's coming stock market crash: 1987 all over again (Fortune)

6 Ira Sohn Conference Notes: Investment Ideas From Hedge Fund Managers (market folly)

Also the following website provides good lessons to investor who wishes to use technical analysis

http://www.onlinetradingconcepts.com/index.html

Sunday, May 23, 2010

What is behind Google’s takeover of AdMob?

The Federal Trade Commission (FTC) shocked the crowds by unanimously approving the takeover of AdMob Inc. by Google Inc. The FTC stated that the takeover will not undermine the competition in the emerging market of mobile advertising. The excuse is not quite convincing though. Mobile advertising is still an emerging industry and that is why Google may not appear as a Monopoly at the moment. Think about that, who would predict Microsoft to become a monopoly in the 1950s? The FTC has always been very tough on the mergers or takeovers that violate the antitrust law. But this time, its attitude has changed radically towards this Internet searching company. What is wrong?

Google seems to receive a lot of benefits from the federal government recently. It just received the permit from Federal Energy Regulatory Commission (FERC) to get into electric business by launching Google Energy. All the members in FERC agreed the Internet search giant to sell electricity like an electric utility. Google knows nothing about the energy industry, how come the FERC allowed it to serve utilities to the public? Google is becoming a conglomerate!

My opinion is that all these are very likely to be related to the closure of Google China. In January, Google, surprised others, threatened the Chinese government that it is going to leave China if the Chinese government fails to provide explanation for the cyber attack on several of its servers and Gmail accounts. In addition, Google asserted that it would no long obey the Chinese law to filter the local search results. Many young people in China praised the American company for its courage to flight for human rights.

However, the whole thing was dubious. It makes no sense for a public traded company to risk leaving one of the biggest Internet markets in the world. It was not being responsible to its investors by taking such a big risk when facing its unfriendly competitors, such as Apple Inc. and Microsoft Inc. How did a little company dare to start a war with a government, which caused the company to lose thousands of contracts in the mainland China? Undoubtedly, Google was bound to lose in front of a regime. The stalemate lasted 2 months and ended with Google closing its Chinese office in Beijing.

At that time, there were many people doubted that the American government was backing the searching engine. The US government is famous for using human rights as a tool to attack developing countries like China. Recent news suggests that Google’s move was very likely a move by the US to pressure China on its human rights issue. The recent approvals by the FTC and FERC are very likely the repayment by federal government for Google’s sacrifice during the battle with the Chinese government.

Although there are still many issues remain dubious and unsolved, we can predict that, in the future, there will be more favor come from the federal government to this Internet giant based in Mountain View, Calif.

Saturday, May 22, 2010

Prologue

So I decided that I am going to write something about anything that is happening in the financial world. It can be a hedge fund portfolio tracking, stock market analysis, event comment and even a book review. Since I am busy with my school work, I am only able to post one or two articles each week. But I hope I can receive some feedbacks from my readers and learn something from them because I am new to this market (which is why I named the Blog Outsider). You can correct my English too since it is not my first language.

Welcome to Outsider

Welcome to Outsider, a blog dedicated to track and provide viewpoints regarding the US financial market. In this blog, the author, Chao, will comment on the US stock market and current world affairs on a weekly basis. Being an international college student here in the US, Chao is still learning about the US markets everyday, which is radically different from the market in his home country. The author is hoping the blog will become an interactive platform for stock traders and finance pros to exchange trading ideas and opinions regarding the complex world.

Just to point out that any opinions and viewpoints at Outsider are for educational purposes only and are personal opinions without related to any organizations or institutions. The author is not responsible for any losses that individuals or organizations make if practicing the strategy here at Outsider.

Sincerely

Chao